In today’s increasingly complex regulatory landscape, Anti-Money Laundering (AML) compliance has become an indispensable part of doing business. Whether you operate in fintech, crypto, or financial institutions, ensuring robust AML measures protects your business from financial crimes, regulatory penalties, and reputational damage. But how do you navigate these challenges efficiently? This guide will walk you through the essentials of AML compliance and how Complium can be your trusted partner in achieving it.

What is Anti-Money Laundering AMl?

Anti-Money Laundering (AML) refers to a set of laws, regulations, and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income. AML compliance focuses on detecting, deterring, and reporting financial crimes such as money laundering, fraud, and terrorist financing.

The key components of AML include:

- Know Your Customer (KYC): Verifying customer identities to assess risks.

- Transaction Monitoring: Analyzing financial transactions for unusual or suspicious activity.

- Reporting: Submitting Suspicious Activity Reports (SARs) to regulatory authorities.

- Ongoing Compliance Programs: Implementing policies, training staff, and conducting regular audits.

By adhering to AML requirements, businesses safeguard their operations, protect their reputation, and contribute to global efforts to combat financial crimes.

Why is AML Compliance Critical for Your Business?

AML compliance is more than just a regulatory requirement— it’s a proactive measure to safeguard your business against money laundering, fraud, and other financial crimes. Failing to adhere to AML regulations can result in severe consequences, including:

- Financial penalties that can cripple your business.

- Regulatory scrutiny leading to operational disruptions.

- Reputational damage that can erode client trust and investor confidence.

By implementing a robust AML compliance program, you not only meet regulatory requirements but also establish a solid foundation for long-term growth and stability.

Real-World Implications of AML Compliance

Businesses that neglect AML compliance risk exposure to financial crime, which can devastate operations. For example, fintech companies processing high volumes of transactions are prime targets for fraudsters and require vigilant monitoring to mitigate risk. Similarly, crypto firms operating in decentralized finance must navigate an evolving regulatory environment where failure to comply can result in loss of licenses and credibility.

Understanding the impact of non-compliance emphasizes the necessity of a robust AML strategy tailored to your business’s needs.

Key Elements of AML Compliance

Building a strong AML program involves several critical components:

1. Risk Assessment and Policy Development

Every business faces unique risks based on its industry, geography, and clientele. A comprehensive risk assessment allows you to tailor your AML policies to address these specific challenges effectively. Policies must cover client onboarding, transaction monitoring, and escalation procedures for suspicious activities.

2. Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD)

Know Your Customer (KYC) procedures form the backbone of AML compliance. Enhanced Due Diligence (EDD) adds an extra layer of scrutiny for high-risk clients or transactions, ensuring your business remains protected. These practices are vital in identifying and mitigating risks before they escalate into compliance violations.

3. Transaction Monitoring and Reporting

Real-time transaction monitoring helps identify and flag suspicious activities. Filing Suspicious Activity Reports (SARs) ensures timely communication with regulatory authorities. Advanced analytics tools and AI-driven insights can enhance your monitoring processes, making them more effective and efficient.

4. Ongoing Training and Awareness

An informed team is your first line of defense. Regular AML training ensures your staff stays updated on the latest regulations and best practices. This fosters a culture of compliance within your organization, reducing the likelihood of accidental breaches.

5. Regular Audits and Updates

AML regulations and risks evolve constantly. Conducting periodic audits ensures your compliance program remains effective and aligned with current standards. This proactive approach mitigates the risk of penalties and operational disruptions.

The Path to AML Compliance: How Complium Simplifies the Process

Getting started with AML compliance might seem daunting, but with Complium, the process is straightforward and customized to your business needs. Here’s how we can help:

1. Initial Consultation

We begin with a consultation to assess your business’s current compliance measures, such as KYC/KYT processes and IT systems. Based on our findings, we recommend tools and strategies to fill any gaps. This phase is critical for identifying vulnerabilities and opportunities to enhance your compliance program.

2. Onboarding and Setup

Our team assigns a dedicated AML Manager to guide you through setting up regulatory access, drafting essential policies, and ensuring seamless integration with compliance systems. During onboarding, we work closely with your team to align processes and ensure all stakeholders understand their roles in maintaining compliance.

3. Policy Development and Implementation

Complium assists in drafting and updating core policies such as AML guidelines, risk analysis documents, and travel rule compliance. These policies are tailored to your industry and operational context, ensuring they are both effective and practical to implement.

4. Ongoing Support and Monitoring

From regular reporting to real-time monitoring, we provide continuous support to keep your business aligned with regulatory standards. Whether it’s submitting SARs or managing audits, we’ve got you covered. Our proactive approach helps you stay ahead of potential compliance issues.

Benefits of Partnering with Complium

Why choose Complium as your AML compliance partner? Here’s what sets us apart:

- Dedicated Compliance Experts: Access a team of seasoned Compliance Officers (COs), Money Laundering Reporting Officers (MLROs), and AML Managers who provide expert support tailored to your needs — all without the overhead of full-time staffing.

- Comprehensive Compliance Management: From onboarding to monitoring, we handle every aspect of your AML program.

- Expert Guidance: Access to seasoned AML professionals ensures your compliance measures are always top-notch.

- Cost-Effective Solutions: Achieve full compliance without the expense of an in-house team.

- Audit Readiness: Meticulous documentation and record-keeping mean you’re always prepared for regulatory scrutiny.

- Tailored Solutions: Every business is unique, and we design our services to meet your specific needs, industry requirements, and operational complexity.

Industries We Serve

At Complium, we tailor our AML solutions to meet the specific needs of various industries:

- Fintech & Crypto: Navigate the heavily regulated markets of fintech and crypto with ease. Our solutions address the fast-paced nature of these industries, ensuring compliance without slowing down innovation.

- Financial Institutions: Ensure compliance with stringent financial regulations to keep transactions secure. From banks to investment firms, our AML services are designed to meet the highest standards.

- E-commerce: Protect your online business from evolving compliance risks with robust AML measures. As e-commerce continues to grow, maintaining compliance is essential to building customer trust.

Expanding Beyond Compliance

In addition to industry-specific solutions, Complium’s services emphasize long-term value. By integrating AML compliance into your broader risk management strategy, we help you build resilience against emerging threats, creating a competitive advantage.

Flexible AML Compliance Packages

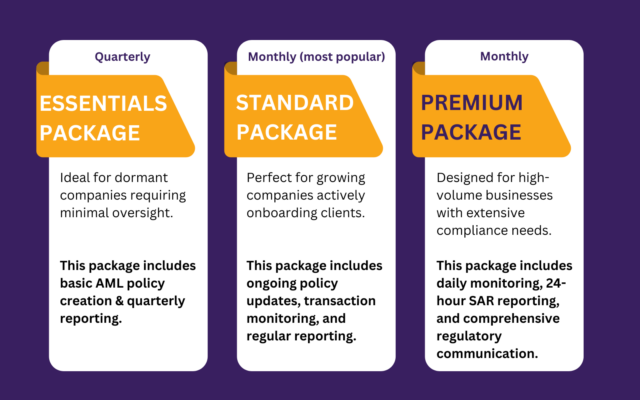

We understand that businesses have varying compliance needs. That’s why Complium offers three tailored packages:

- Quarterly Essentials Package – Ideal for dormant companies requiring minimal oversight. This package includes basic AML policy creation and quarterly reporting.

- Monthly Compliance Package – Perfect for growing companies actively onboarding clients. It provides ongoing policy updates, transaction monitoring, and regular reporting.

- Premium Monthly Compliance Package – Designed for high-volume businesses with extensive compliance needs. This package includes daily monitoring, 24-hour SAR reporting, and comprehensive regulatory communication.

Each package includes access to a dedicated AML team, ensuring your business remains compliant and protected.

The Future of AML Compliance

As regulatory requirements continue to evolve, businesses must adapt to remain compliant. Emerging technologies such as AI-driven analytics, blockchain transparency, and real-time data monitoring are reshaping the compliance landscape.

The Role of Technology in AML Compliance

Advanced tools can enhance your compliance efforts by automating routine tasks, identifying patterns in transaction data, and generating real-time alerts for suspicious activities. Leveraging these technologies reduces human error and allows your compliance team to focus on strategic priorities.

Take the Next Step

AML compliance is not just a requirement; it’s a strategic advantage. By choosing Complium, you gain a partner dedicated to simplifying compliance, reducing risks, and empowering your business to grow confidently.

Ready to secure your business? Book a FREE consultation with our AML experts today and discover how Complium can help you achieve comprehensive compliance.

One comment

Pingback: Outsourcing AML Compliance and KYC Reporting: A Strategic Move for Fintech and Crypto Businesses - COMPLIUM |

Comments are closed.